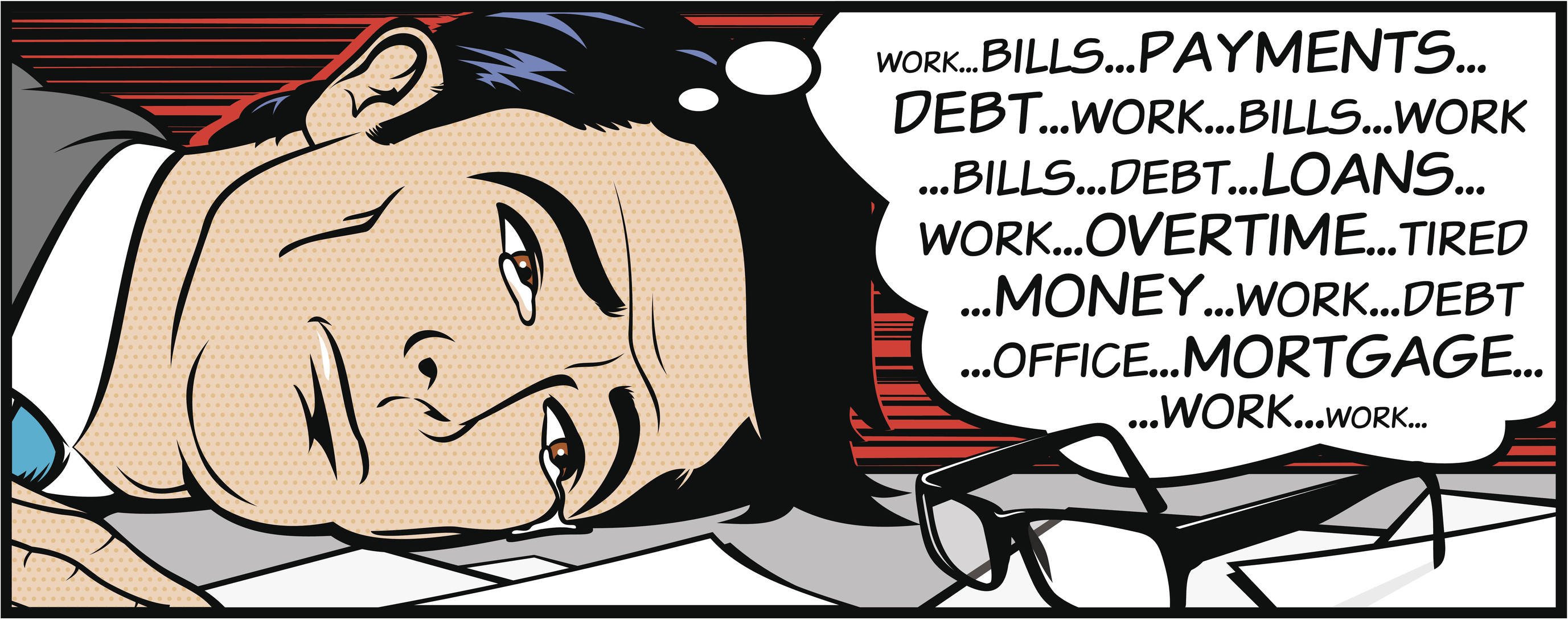

Increasing financial pressure is causing more and more stress for Canadians, according to a recent survey by Capital One Canada and Credit Canada Debt Solutions. In fact, 44 percent of Canadians believe their mental health is adversely affected by their financial situation.

“Money is an emotional topic and is one of the biggest sources of stress in people’s lives, but it is rarely talked about,” said Patrick Ens, VP of Strategy and Brand, Capital One.”

In order to save money, 76 percent of Canadians surveyed reported that they skipped vacations, expensive dinners, and personal grooming to stay afloat. Fifty-six percent make “drastic sacrifices” to pay off their debt, such as never travelling or vacationing again (23 percent), not eating out (21 percent), and following a no-spend lifestyle (20 percent).

Capital One and Credit Canada have teamed up for Credit Education Week, which takes place Nov. 13-16, to “educate and empower Canadians” and give them the ability to tackle financial anxiety.

“We are aiming to help Canadians begin conversations around money, their relationship with it and how actively prioritizing and managing finances can alleviate stress,” said Ens. “With the right resources, people can confidently plan to achieve their financial goals, whatever that may be.”

Thirty percent of Canadians claim financial stress is more worrying than overall health, according to the #MoneyMindfulness survey. Canadians also reported spending an average of seven hours a week worrying about finances. Others spend as much as 16 hours a week worrying about financial stress.

“These results demonstrate that most Canadians worry about their finances every day for about an hour, which is equivalent to the amount of time we spend eating,” noted Laurie Campbell, Credit Canada’s CEO. “But worrying doesn’t solve anything. The only way to deal with financial stress is to resolve through education, sound money management and using the financial tools that are readily available – that’s what Credit Education Week is all about.”

Even though 60 percent of Canadians are working their way towards lessening their financial anxiety, many are still struggling. The goal of Credit Education Week is to help people manage their finances through a number of resources.

Events are being held throughout the country over the next couple of weeks, including, financial literacy workshops, PowerPoint displays, money mindfulness meetings, debt/money management workshops, credit education seminars, and investment workshops. Check out a list of events here.