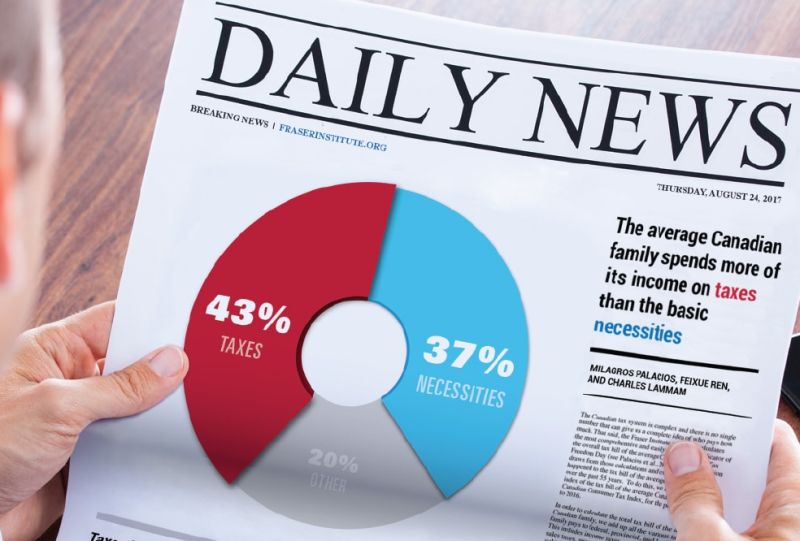

A new report shows that the average Canadian family spent 42.5 per cent of their income on taxes last year, more than they spent on housing, food, and clothing combined.

Conventional wisdom used to suggest that we should spend no more than 30 per cent of their income on rent. I’m not sure that is actually feasible anymore, especially in some of Canada’s biggest cities where the cost of rent and real estate have skyrocketed in recent years.

Still, despite the high cost of putting a roof over your head, you’re paying more in taxes than you are in rent. Canadians are actually paying more money in income tax than they spend on anything else. Those are the findings of a new report out just today from the Fraser Institute.

“Many Canadians may think housing is their biggest household expense, but in fact the average Canadian family spent more on taxes last year than on life’s basic necessities—including housing,” said Charles Lammam, director of fiscal studies at the Fraser Institute and co-author of the Canadian Consumer Tax Index, which tracked the total tax bill of the average Canadian family from 1961 to 2016.

According to their findings, last year, the average Canadian family earned $83,105 and paid $35,283 in total taxes – compared to $31,069 on housing (including rent and mortgage payments), food and clothing combined.

In fact, the average Canadian family paid nearly twice as much of their income in taxes (42.5 per cent) as they did for housing (22.1 per cent). The basic necessities of life, which include food, clothing and housing, amounted to just 37.4 per cent of income—still less than the percentage of income going to taxes.

In contrast to today’s 42.5 per cent tax, in 1961, the average family had an income of $5,000 and paid a total tax bill of $1,675 (33.5%).

“Taxes help fund important public services that Canadians rely on, but the issue is the amount of taxes governments take compared to what Canadians get in return,” Lammam said. “With more than 42 per cent of their income going to taxes, Canadians might ask whether they’re getting good value for their tax dollars.”

How much income tax you will pay in 2017

The amount of federal income taxes you pay increases as your earnings go up. The basic formula is:

- 15% on the first $45,916 of taxable income, +

- 20.5% on the next $45,915 of taxable income (on the portion of taxable income over $45,916 up to $91,831), +

- 26% on the next $50,522 of taxable income (on the portion of taxable income over $91,831 up to $142,353), +

- 29% on the next $60,447 of taxable income (on the portion of taxable income over $142,353 up to $202,800), +

- 33% of taxable income over $202,800.

The federal government website contains an interactive calculator where you can input your own numbers to see precisely how much income tax you will pay this year. You can find it here.

For more details and the full charts, you can read the full Canadian Consumer Tax Index, 2017 from the Faser Institute. (Opens as a PDF.)